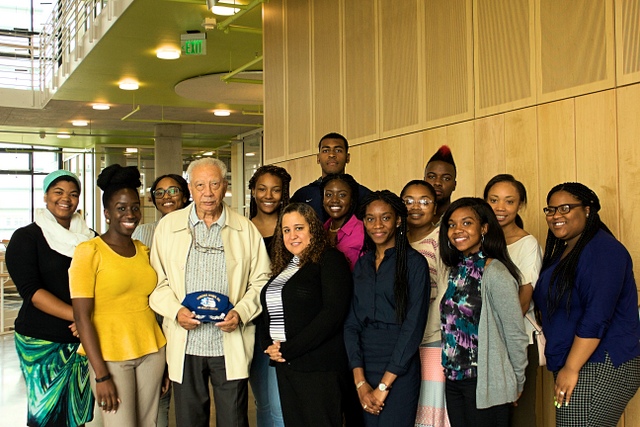

SINGAPORE — Mrs Lee Suet Fern, the wife of Mr Lee Hsien Yang, has stepped down as managing partner of her law firm’s Singapore office, TODAY has learnt.

She will continue helming its international leadership team. Her successor, Mr Ng Joo Khin, has been appointed as managing partner of Morgan Lewis Stamford’s Singapore office and will oversee the firm’s day-to-day operations here.

The leadership transition has been in the works for some time, as part of the company’s regular transition process, TODAY understands. The news was communicated by the law firm to some of its staff earlier this week.

In the past week, Mrs Lee, 59, has been in the spotlight over her role in the saga among the Lee siblings over their Oxley Road family home. Mr Ng’s name has also cropped up in the controversy, as he was the one whom Mrs Lee said had handled the preparation of founding Prime Minister Lee Kuan Yew’s final will, based on an edited summary of Prime Minister Lee Hsien Loong’s statutory declaration — which was released publicly on Thursday (June 15) — to the Cabinet committee set up to mull over the options for the home. PM Lee has questioned Mrs Lee’s role in the will and whether there was conflict of interest on her part.

As head of Morgan Lewis’ international leadership team, Mrs Lee will be based both in Singapore and Hong Kong. This group comprises the managing partners of all the firm’s offices outside the United States and a partner in New York.

When contacted by TODAY, a spokesperson for Morgan Lewis said on Thursday that the firm “does not anticipate any material change in (its) Singapore team or practice”.

“(Mrs Lee) will continue to spend a significant amount of time in Singapore as well as travel to Hong Kong, as she already does in support of her strong client relationships there and as head of our international leadership team,” the spokesperson added. Mrs Lee declined comment when approached.

On Wednesday, Mr Lee Hsien Yang, 60, had said in a joint public statement with his sister, Dr Lee Wei Ling, 62, that he would be leaving Singapore for “the foreseeable future”. On the same day, he told this newspaper that his wife, Suet Fern, was considering whether to leave the country as well. “We’re looking at what we want to do and what we should do,” he said.

A leading corporate lawyer, Mrs Lee founded Singapore-based regional law firm Stamford Law Corporation — now known as Morgan Lewis Stamford — about 17 years ago. Her areas of focus include mergers and acquisitions, and corporate finance. She has been involved in a host of corporate transactions in Singapore and the region. The Cambridge-educated lawyer also sits on the boards of public-listed firms, including insurance firm AXA. Until last year, she was also chairman of the Asian Civilisations Museum.

REBUTTAL

Meanwhile, in a span of several hours on Friday, Mr Lee Hsien Yang came out twice to rebut PM Lee’s concerns over the role his wife and her law firm played in the drafting of Mr Lee Kuan Yew’s wills.

In his first post on Facebook, early on Friday morning, he stated that Stamford Law did not draft his father’s Last Will. He said his brother’s “claimed recollection to that effect is clearly erroneous”, adding, “LHL’s (Lee Hsien Loong’s) secret committee ignored it”.

Before ending the post with a question – “besides, we thought this was a ‘private family matter?’, a reference to the PM’s earlier statement that the airing of the feud had saddened him – Mr Lee Hsien Yang also said both he and Dr Lee had already responded to a ministerial committee’s questions on how the Last Will was prepared, and the role played by Mrs Lee Suet Fern and Stamford Law in it. Calling the PM’s assertion “a lie”, he said they had responded on Feb 28.

In a post several hours later, at 1.05pm, he went further, saying: “Stamford Law did not draft any will for LKY. The will was drafted by Kwa Kim Li of Lee & Lee.”

Rebutting “grave concerns” raised by PM Lee on Thursday over the role played by Mrs Lee and the potential conflict of interest on her part, Mr Lee Hsien Yang added: “Paragraph 7 of the Will was drafted at LKY’s (Lee Kuan Yew’s) direction, and put into language by Lee Suet Fern his daughter in law and when he was satisfied he asked Kim Li to insert it into his will.”

The Stamford lawyers were called in to witness the signing of the will on express written instructions from his father, and it was Mr Lee Kuan Yew’s estate that had instructed the law firm to extract probate.

On the role of Mr Ng, Mr Lee Hsien Yang said it was to read the will to the beneficiaries.

Stamford Law formed a significant part in PM Lee’s statutory declarations, which were made to the ministerial committee looking into options for the family home at 38, Oxley Road. In them, Mr Lee said Mrs Lee Suet Fern had said that his father asked her to prepare his Last Will, but as she did not want to get personally involved, she got a lawyer from her firm of Stamford Law to do so instead.

The Last Will differed markedly from a previous version: It gave an equal share of the late Mr Lee’s estate to all of his children, and contained a clause stating that the founding PM wanted the Oxley Road house demolished after his death.

By contrast, the previous version of the will gave a larger share of the estate to Dr Lee Wei Ling, and did not contain the so-called demolition clause.

The latest posts continued the pushback from the Lee siblings following the release of the PM’s statutory declarations.

On Thursday night, Dr Lee Wei Ling posted several rebuttals on Facebook, accusing the PM and his wife, Madam Ho Ching, of being “mischievous and dishonest” by selectively using quotes from her out of context to suggest that Mr Lee Hsien Yang and his wife were trying to cheat her out of their father’s final will.

The long-running dispute over the fate of 38, Oxley Road spilled over on Wednesday, when Mr Lee Hsien Yang and Dr Lee issued their six-page statement alleging that they felt “threatened” in their attempt to carry out their late father’s wish to demolish their family home on 38 Oxley Road. That statement alleged persecution.

PM Lee denied their allegations, saying they saddened him and tarnished their father’s legacy. He and Madam Ho also rubbished claims that he had political ambitions for his son, Mr Li Hongyi, who later weighed in to state that he had no such designs.

On Friday, Mr Lee Hsien Yang’s son, Mr Li Shengwu, also weighed in. In a Facebook post at 3.44am, he wrote: “Not only do I intend never to go into politics, I believe that it would be bad for Singapore if any third-generation Lee went into politics. The country must be bigger than one family.”

Go to Source