More than ten international and domestic companies are keen to partner with Chile’s Codelco, the world’s biggest copper producer, to develop its massive lithium assets in the country’s north, the firm’s chairman Oscar Landerretche said Tuesday.

Speaking to Reuters during LME Week, Landerretche didn’t disclose any names, but noted the company’s lithium possessions are two salt lakes in “very early stages” of exploration and development.

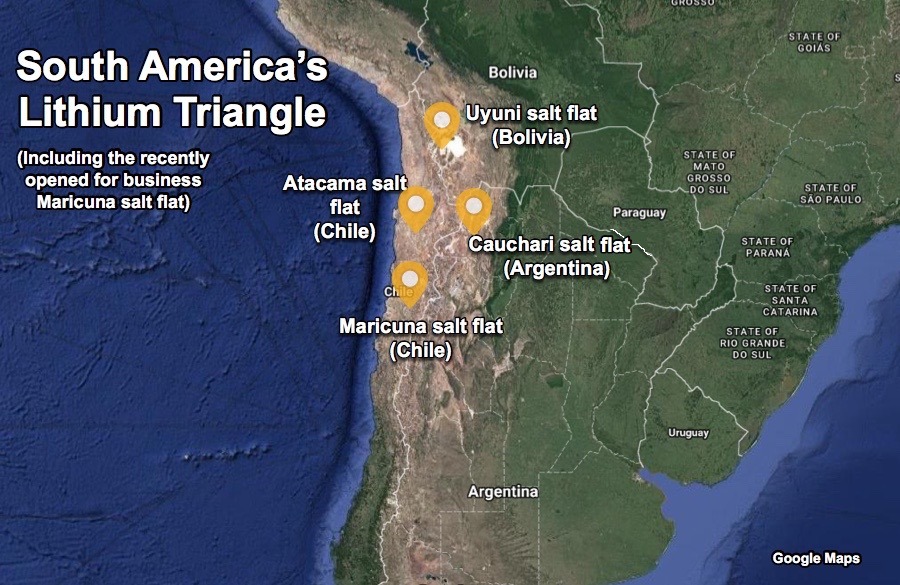

The state miner began seeking private-sector partners to develop and exploit its Maricunga and Pedernales deposits in January. Shortly after, it set up a subsidiary to spearhead the process.

The state miner began seeking private-sector partners to develop and exploit its Maricunga and Pedernales deposits in January and, shortly after, it set up a subsidiary to spearhead the process. The move was part of a broader plan conceived by the National Lithium Commission to further develop the country’s lithium sector, which includes opening it to foreign companies.

Due to a law that dates back to the late 1970’s, the white-silver metal is considered “strategic” for Chile. As a result, lithium producers need to obtain a license from both the Chilean Nuclear Energy Commission (CCHEN by its Spanish initials) and the Mining Ministry.

The Ministry hasn’t awarded a permit in more than two decades, while CCHEN has only ever approved new quotas for two firms besides Codelco — US-based Albemarle Corp., and Soc. Química & Minera de Chile (SOQUIMICH).

The copper miner was recently granted the right — transferable to third parties — to produce 325,045 tonnes over 40 years, a figure that while not extremely big, could help reduce a looming lithium supply deficit.

According to Goldman Sachs Group, supply growth seems too slow, which is creating bottlenecks that pose “serious risks” to the future of mass adoption of electric vehicles, it said in a note early this month.

Opening up Chile’s vast salt flats to production could reduce those risks. The country has half of the world’s most “economically extractable” reserves of the metal, according to the US Geographical Survey (USGS). It is also the world’s lowest-cost producer, thanks to an efficient process that makes the most of the country’s climate.

In terms of output, Chile shares the post with Australia as one the world’s largest producers of the metal, frequently referred to as “white petroleum,” which has become an irreplaceable component of rechargeable batteries used in high tech devices and electric cars.

By: MINING.com.