U.S. business groups are pushing a Senate bill that would let companies import an unlimited number of government-subsidized, foreign graduates to replace middle-class American employees.

The middle-class outsourcing bill would allow CEOs and investors to cut payroll for American college graduates, then spike their profits and stock options at the lifetime expense of the American middle-class.

Business lobbyists are describing the bill as a fix for a supposed shortage of tech workers, but it would have a much wider impact, says Mark Krikorian, the director of the Center for Immigration Studies. Tech-trained people are “not a hermetically segregated population,” he said.

“I have one kid in computers and another one in medical school … [and] everybody has family members who are involved in [technology] fields, so it affects everybody even if what you are doing is unrelated” to cutting-edge technology, he said. The Americans who are pushed out of technical fields by low salaries will crowd into other sectors, so nudging down more salaries, he said.

The January 25 bill is titled the Immigration Innovation Act of 2018, or I-Squared. It is being fronted by Sen. Orrin Hatch and Sen. Jeff Flake, who are frequently described as “moderate” by the establishment media.

The two Senators may try to attach their outsourcing plan to the pending amnesty and immigration bills, but it will likely complicate politicians’ effort to an unpopular amnesty for at least 1.8 million non-college ‘dreamers.’ However, the bill shows business groups want the next wave of immigrants to help cut the payroll costs of American college graduates.

These business groups’ statements were included in a press release by Flake and Hatch.

“Our future – and the competitiveness of the entire US tech sector – requires that we recruit some of the best and brightest in the world … ensuring that we can recruit people to fill jobs here in the US,” said a statement from Brad Smith, the president of Microsoft.

“Facebook is pleased … we look forward to working to ensure its passage into law,” said Erin Egan, vice-president for public policy at Facebook.

Immigration lawyers are delighted because the bill is so complex that companies must hire them before getting to the foreign workers. Cyrus Mehta, an N.Y.-based immigration lawyer, wrote:

This bill has all the right ingredients – elimination of per country limits, not counting derivative family members that have till now clogged up the employment-based preferences and increasing the H-1B visa cap. We need I-Squared as much as a fix for DACA recipients.

Those business leaders are often praised for their pro-immigration stance by establishment white-collar reporters, many of whom have siblings, peers, parents, and children who are the targets of white-collar outsourcing bill.

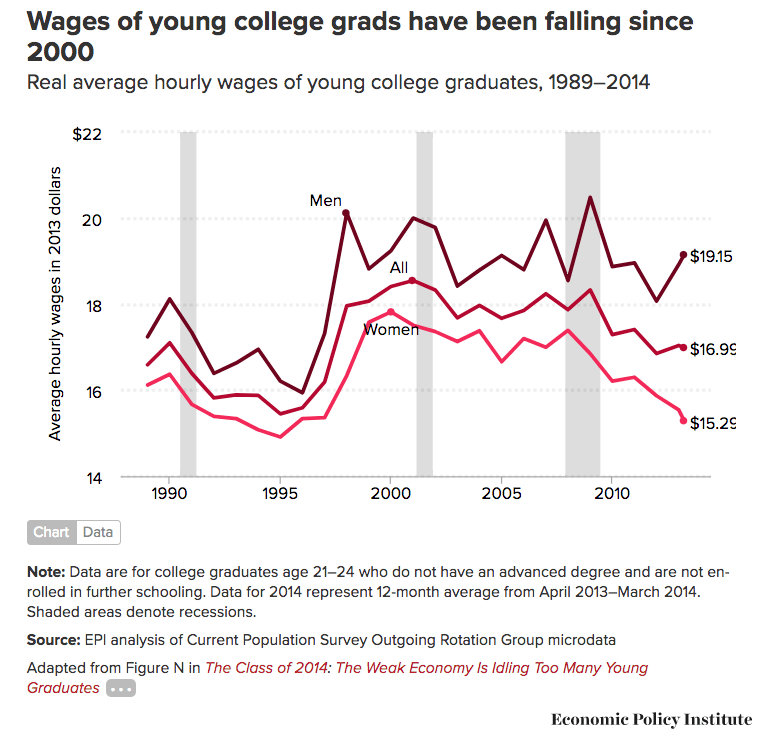

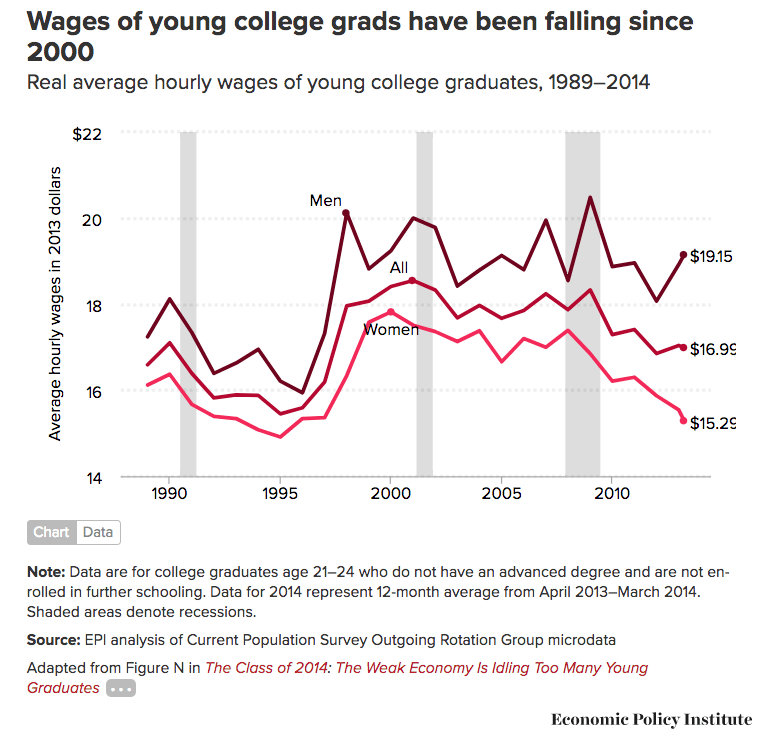

Each year, roughly 800,000 Americans graduate with degrees in medicine, business, architecture, math, science, engineering and computers. The young Americans already face salary-cutting competition from a diverse army of roughly 2 million resident foreign white-collar workers, plus roughly 150,000 new employer-sponsored legal immigrants.

The bill hides its radical goals amid complexity and rhetorical fig leaves.

For example, the bill requires extra paperwork for companies which hire more than half their staff from abroad. It requires companies to pay minor payments so that Americans can be educated for jobs that will be given to the foreign job-seekers, and it sets limits on companies’ use of H-1B foreign workers — although the limits are so high that few companies will ever reach them. The token safeguards also allow advocates to use positive-sound terms in their statements, including “merit-based immigration,” “best and brightest,” and “investing in STEM education.”

The bill uses complexity to hide from the media the multiple ways in which it would blow the doors off the current limits on white-collar immigration which protect Americans graduates from cheap-labor immigration. Here’s some jargon from a summary:

- Expanded cap exemptions: The following foreign nationals would be exempt from the employment-based immigrant visa quota: (1) EB-1A extraordinary ability foreign nationals; (2) EB-1B outstanding professors and researchers; (3) holders of U.S. advanced degrees in designated STEM fields; and (4) spouses and children of employment-based immigrants.

What that paragraph means is that any foreigner who gets a low-quality postgraduate degree that includes some science, technology, engineering or math also gets a hugely valuable green card to live in the United States for the rest of his or her life. The number is uncapped; the annual arrivals could be 1,000, 10,000 or 100,000 — so flooding the U.S. marketplace for skilled white-collar labor.

The legislation also offers a huge and hidden federal subsidy for companies which hire foreigners instead of Americans.

The subsidy is the offer of American citizenship to foreign workers who work for an American company. The offer creates a huge incentive for foreign professionals to accept very low wages in hope of getting the deferred bonus of citizenship after a few years. That offer also serves as a hidden subsidy to companies who hire cheap foreigners instead of debt-burdened American students.

The bill’s focus on science, engineering, and technology also “continues the assault on the ability of Americans to make a career in those fields,” Krikorian said, adding:

It will likely deter more young people from going into those kinds of fields, creating even more justifications for lobbyists to say ‘We have to import more foreign workers’ … This is a broad national problem because having an adequate supply of domestic technical workers is an essential part of economic success as well as national security … but we’re importing people into tech fields in very large numbers, not just a handful of truly exceptional talents.

Moreover, many of the so-called “STEM” careers lead people into diverse management, medicine, research, university, teaching, and business jobs in many cities. So Hatch and Flake’s proposed law would invite many employers to exclude many Americans — especially if foreign-born hiring managers also begin to favor their fellow immigrants.

The bill offers several new ways for more foreign graduates to get jobs in the United States:

The legislation would remove the annual 20,000 cap on H-1B visas for foreign students who earn a Master’s degree at U.S.-based colleges. Once the cap is removed, an unlimited number of foreign students could pay tuition to get H-1B work permits for white-collar jobs in the United States. Unlimited really does mean unlimited — so a new industry would likely emerge to match Americans employers with a rapidly growing number of foriegn graduates from post-gadual schools in America.

The bill would allow imported guest-workers to apply for green cards even when the backlog is so great that the workers cannot get card for many years. But the early application allow the imported to get a long-term “Employment Authorzation Document.”

The bill expands the H-1B guest-worker program by giving H-1B visas to 195,000 foreign graduates who do not have master’s degrees, up from 65,000 today, The H-1B visas last up to six years, so the expanded program would allow companies to keep a population of roughly 1 million non-masters H-1B workers in the United States, or roughly 450,000 employees above today’s level. Non-profits, such as universities, are now allowed to hire an unlimited number of H-1Bs.

The bill would bypass the existing 140,000 per year limit on the award of green cards to foreign employees by exempting the spouses and children of imported workers from the cap. That change would provide green cards to roughly 70,000 extra foreign graduates per year.

Companies would be allowed to import 35,000 foreign professionals per year for “conditional permanent residence” at a cost per employee of only $10,000.

The bill would provide a legal foundation for the agency-created “Optional Practical Training” visa, which now provides up to three years of visas for roughly 330,000 foreigners who are either students or graduates of American colleges. The legal foundation would prevent the program from being shut down by a lawsuit.

All foreign students would be declared F-1 “dual intent” students, meaning they could apply for work permits.

The unused visas for foreign workers that were not issued from 1992 to 2013 would be redistributed to employers.

The bill would provide work permits to the spouses of foreign workers who in line for a green card.

The bill eliminates national caps on hiring of employees from particular countries, so allow a huge new influx of employes and India and China.

The bill’s complexity serves several purposes. It maximizes payments to immigration lawyers, it deters and chokes media coverage of the push, and it allows politicians to loudly complain about some aspects preserving other aspects — especially the uncapped, unlimited, unrestricted, unending postgraduate inflow.

The new inflows of professional workers would come on top of the existing programs which provide work visas for a resident army of roughly 2 million foreign guest-workers who now hold college jobs in Americans business sector. Many of these workers hold H-1B, L-1, J-1, or OPT visas and work permits.

The outsourcing trend is also exacerbated by rules in several states which allow illegals to work as certified professionals, such as lawyers, teachers, doctors, security guards, therapists, and much else. The pro-illegal states include California and New York, both of which also have very high levels of economic inequality, partly because house prices and rents balloon whenever poor migrants crowd into an urban area.

New Jersey’s Democratic Senator, Cory Booker, for example, recently applauded an illegal immigrant who is now allowed to practice laws in the state.

Business has several advantages in their push to pass this nation-changing outsourcing program.

The establishment media does not follow the money in the immigration debate.

The activist left, and the establishment media’s focus on sympathetic groups of foreigners, such as the business-backed ‘dreamers,’ while ignoring the business interests that use immigration to cut Americans’ salaries. The left/media support for migration ensures that public opposition to amnesty — or of mere favoritism towards fellow Americans — is often deemed as racist by many younger left-of-center, urban, white-collar graduates. Ironically, those graduates’ jobs are targeted by the Microsoft/Facebook outsourcing bill.

Business-first GOP legislators tend to be more supportive of outsourcing programs, but their influence is muted by President Donald Trump’s populist pro-American faction.

Four million Americans turn 18 each year and begin looking for good jobs in the free market.

But the federal government inflates the supply of new labor by annually accepting roughly 1.1 million new legal immigrants (including roughly 750,000 working-age migrants), by providing work-permits to roughly 3 million resident foreigners, and by doing little to block the employment of roughly 8 million illegal immigrants.

The Washington-imposed economic policy of economic growth via mass-immigration floods the market with foreign labor, spikes profits and Wall Street values by cutting salaries for manual and skilled labor offered by blue-collar and white-collar employees. It also drives up real estate prices, widens wealth-gaps, reduces high-tech investment, increases state and local tax burdens, hurts kids’ schools and college education, pushes Americans away from high-tech careers, and sidelines at least 5 million marginalized Americans and their families, including many who are now struggling with opioid addictions.

The cheap-labor policy has also reduced investment and job creation in many interior states because the coastal cities have a surplus of imported labor. For example, almost 27 percent of zip codes in Missouri had fewer jobs or businesses in 2015 than in 2000, according to a new report by the Economic Innovation Group. In Kansas, almost 29 percent of zip codes had fewer jobs and businesses in 2015 compared to 2000, which was a two-decade period of massive cheap-labor immigration.

Because of the successful cheap-labor strategy, wages for men have remained flat since 1973, and a large percentage of the nation’s annual income has shifted to investors and away from employees.

Go to Source

Getty Images

Getty Images