NEW YORK, NY / ACCESSWIRE / August 11, 2017 / Pomerantz LLP is investigating claims on behalf of investors of The Advisory Board Company (”Advisory Board” or the ”Company”) (NASDAQ: ABCO). Such investors are advised to contact Robert S. Willoughby at rswilloughby@pomlaw.com or 888-476-6529, ext. 9980.

The investigation concerns whether Advisory Board and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

[Click here to join a class action]

On December 10, 2014, Advisory Board announced that it had signed a definitive agreement to acquire Royall & Company (”Royall”). The Company completed the acquisition of Royall on January 9, 2015. On February 23, 2016, Advisory Board announced a net loss of $101.8 million for the quarter ended December 31, 2015, compared to a net loss of $5.4 million for the quarter ended December 31, 2014. According to the Company, the increase in net loss was primarily attributable to an impairment charge of $95.7 million (subsequently increased to $99.1 million) to Royall’s goodwill, due to Royall’s ”first year performance being below the expectations we had set as of the acquisition date.” Royall produced only $118 million in revenue in 2015, compared to the Company’s guidance of $125 million to $130 million.

Following this news, the Company’s share price fell $9.79, or 26.98%, to close at $26.50 on February 24, 2016.

The Pomerantz Firm, with offices in New York, Chicago, Florida, and Los Angeles, is acknowledged as one of the premier firms in the areas of corporate, securities, and antitrust class litigation. Founded by the late Abraham L. Pomerantz, known as the dean of the class action bar, the Pomerantz Firm pioneered the field of securities class actions. Today, more than 80 years later, the Pomerantz Firm continues in the tradition he established, fighting for the rights of the victims of securities fraud, breaches of fiduciary duty, and corporate misconduct. The Firm has recovered numerous multimillion-dollar damages awards on behalf of class members. See www.pomerantzlaw.com

SOURCE: Pomerantz LLP

ReleaseID: 472429

—

NEW YORK, NY / ACCESSWIRE / August 11, 2017 / Pomerantz LLP is investigating claims on behalf of investors of The Advisory Board Company (”Advisory Board” or the ”Company”) (NASDAQ: ABCO). Such investors are advised to contact Robert S. Willoughby at rswilloughby@pomlaw.com or 888-476-6529, ext. 9980.

The investigation concerns whether Advisory Board and certain of its officers and/or directors have engaged in securities fraud or other unlawful business practices.

[Click here to join a class action]

On December 10, 2014, Advisory Board announced that it had signed a definitive agreement to acquire Royall & Company (”Royall”). The Company completed the acquisition of Royall on January 9, 2015. On February 23, 2016, Advisory Board announced a net loss of $101.8 million for the quarter ended December 31, 2015, compared to a net loss of $5.4 million for the quarter ended December 31, 2014. According to the Company, the increase in net loss was primarily attributable to an impairment charge of $95.7 million (subsequently increased to $99.1 million) to Royall’s goodwill, due to Royall’s ”first year performance being below the expectations we had set as of the acquisition date.” Royall produced only $118 million in revenue in 2015, compared to the Company’s guidance of $125 million to $130 million.

Following this news, the Company’s share price fell $9.79, or 26.98%, to close at $26.50 on February 24, 2016.

The Pomerantz Firm, with offices in New York, Chicago, Florida, and Los Angeles, is acknowledged as one of the premier firms in the areas of corporate, securities, and antitrust class litigation. Founded by the late Abraham L. Pomerantz, known as the dean of the class action bar, the Pomerantz Firm pioneered the field of securities class actions. Today, more than 80 years later, the Pomerantz Firm continues in the tradition he established, fighting for the rights of the victims of securities fraud, breaches of fiduciary duty, and corporate misconduct. The Firm has recovered numerous multimillion-dollar damages awards on behalf of class members. See www.pomerantzlaw.com

SOURCE: Pomerantz LLP

ReleaseID: 472429

Source URL: http://marketersmedia.com/shareholder-alert-pomerantz-law-firm-investigates-claims-on-behalf-of-investors-of-the-advisory-board-company-abco/228489

Source: AccessWire

Release ID: 228489

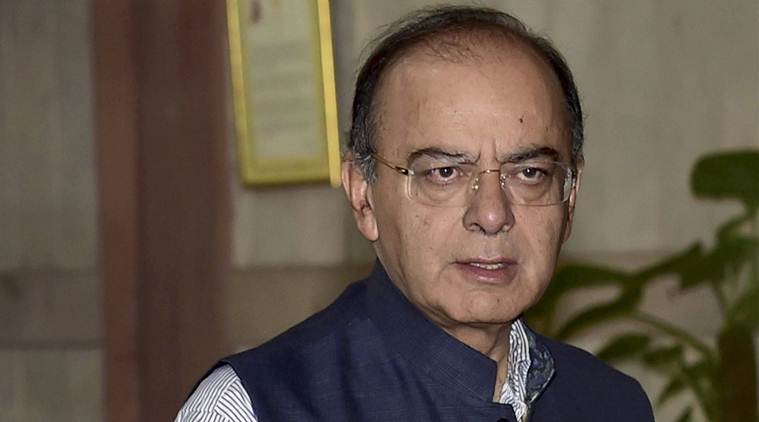

Replying to MPs, Jaitley mentioned SEBI’s action against suspected shell companies on stock exchanges, saying, “Caazaar mein thoda uthal puthal hua (there was some turmoil in the markets).” (File photo)

Replying to MPs, Jaitley mentioned SEBI’s action against suspected shell companies on stock exchanges, saying, “Caazaar mein thoda uthal puthal hua (there was some turmoil in the markets).” (File photo)