Private equity has been largely outbid or left out completely of dealmaking so far this year, despite the fact that it is sitting on a record amount of cash.

So now buyout firms are

The rush to raise investment dough comes amid a tough start to this year. In the first quarter, private equity firms accounted for just 16.9 percent of North American deal value, down from 20.4 percent in the first quarter of 2016, according to a PitchBook report on the first quarter.

Private equity firms did not close any transactions valued at more than $2.5 billion in the first three months of this year, while strategic acquirers closed eight deals of that size or more, the report showed.

“Similar to what we saw last year, we believe private equity acquisitions are being crowded out by strategic acquisitions,” said Pitchbook analyst Dylan Cox.

One high-profile case last year was Verizon’s deal to buy Yahoo, reportedly beating out private equity bidders.

Private equity firms, which include Blackstone and KKR, have typically used investors’ capital to buy a variety of companies, grow those businesses and then sell them for a profit. Now analysts say the financial firms are trying to build an edge to complete deals before time runs out.

“Private equity can’t compete against corporations,” especially since they often lack a business case to win deals, Stephen Weiss, founder and managing partner of Short Hills Capital Partners, told CNBC. “They’ve got to put money to work before money gets repatriated and interest rates go up.”

In the last few days, private equity firms have made some strides. On Tuesday, telephone conference company West said it agreed to be acquired by Apollo Global Management in a deal valued at more than $5 billion. Then The Wall Street Journal, citing sources, said Wednesday that power generator Calpine “has attracted interest from a number of private equity firms.”

The corporate bidding wars have ramped up at the same time. Late Wednesday, the Journal, citing people familiar with the matter, said Verizon almost doubled

But the buyout firms aren’t bowing out yet.

“A lot of the investors I talk to are getting capital calls from multiple private equity funds. New funds are being launched every day,” Weiss said. “You’ve got this explosion of assets under management.”

A capital call is a request for a portion of a limited partner’s committed funds to pay for an investment.

Rising interest rates means borrowing money to buy another company is more expensive. The Trump administration also has proposed a cut in the tax rate for returning overseas

That’s putting pressure on private equity firms to raise even more money and fight for deals sooner.

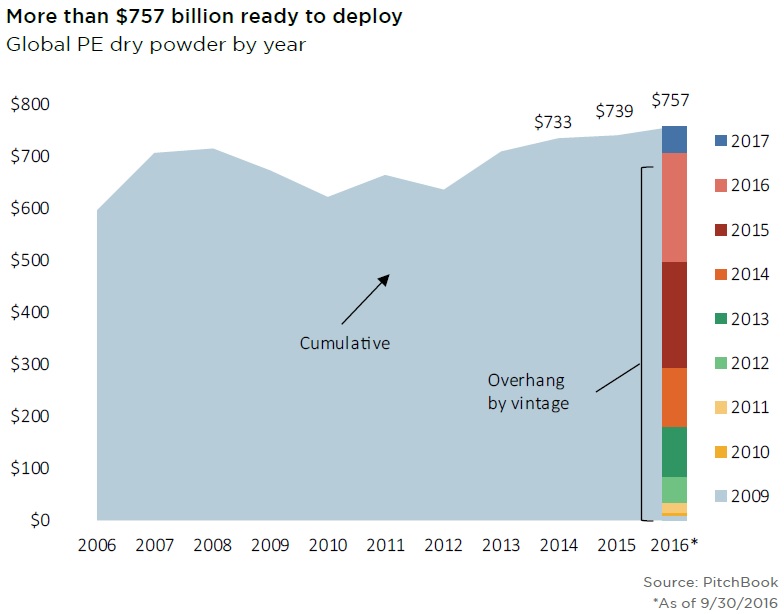

Capital available for use, or dry powder, is a record $757 billion for North American and European funds, according to PitchBook.

Meanwhile, prices for U.S. deals reached their highest multiple on record at PitchBook as measured by the ratio of enterprise value to earnings before interest, taxes, depreciation and amortization.

Source: PitchBook

Corporations can already offer a much higher price than private equity-backed deals and beat out the investment firms by a wide margin in all 11 S&P 500 sectors, according to S&P Global Market Intelligence data from the last 12 months.

For example, in technology, Microsoft acquired LinkedIn in June for more than $25 billion. In the last year, S&P data showed the largest private equity deal in tech was a $3.55 billion sale of Thomson Reuter’s intellectual property and science business unit to private equity firms Onex and Baring Private Equity Asia.

“Those spreads are probably now wider than they were back in ’07, ’08, back in the heyday of private equity,” said Richard Peterson, principal analyst at S&P Global Market Intelligence.

Going forward, analysts said earnings growth and repatriation should mean companies have no shortage of cash to spend.

More companies and more funds bidding for the same deals is forcing private equity firms to show they also have the expertise to grow a business in a certain industry, analysts said.

“To some degree you see private equity taking a page in terms of doing deals strategically,” said Robert Haas, a partner at A.T. Kearney and leader of the firm’s private equity and strategy and top-line transformation practices for the Americas region. “More and more private equity firms are bringing on teams, getting involved in the transformation of their portfolio companies.”

For example, private equity firm New Mountain Capital purchased laboratory products company Avantor from Covidien in 2010. Last Friday, Avantor announced a deal to buy life sciences supply chain company VWR in a deal valued at more than $6 billion.

Global private equity mergers and acquisitions so far this year are up 44 percent from the same period last year at $183.4 billion in deals, according to Thomson Reuters data as of May 4.

“You’re seeing large pools of money being raised without the large deal recovery,” said Barry Curtis, private equity leader at Deloitte’s M&A transactions practice. “That tells me private equity sees a lot of opportunity going forward to deploy that capital.”